indiana tax payment plan

If you have an account or would like to create one or if you. Tax Exempt Organization Search.

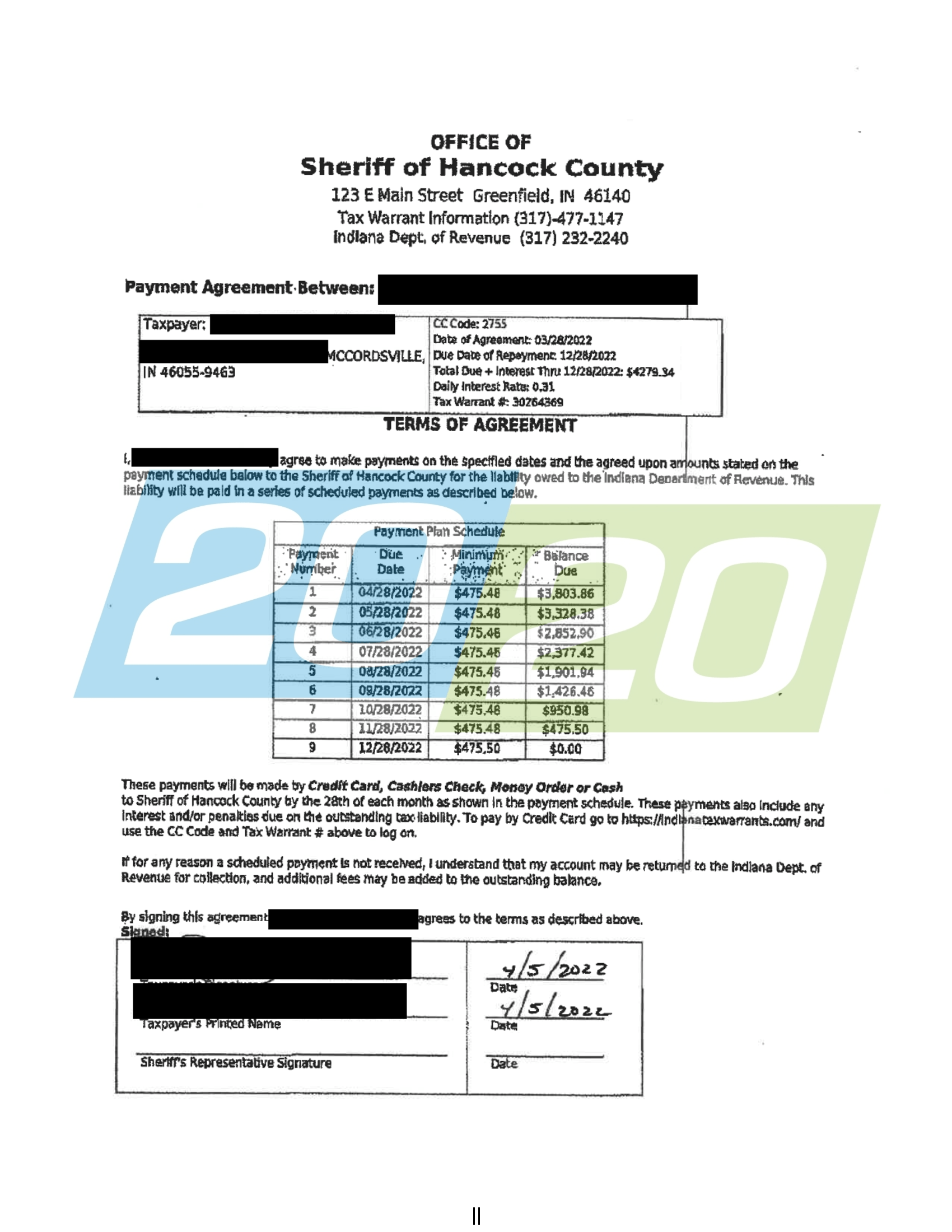

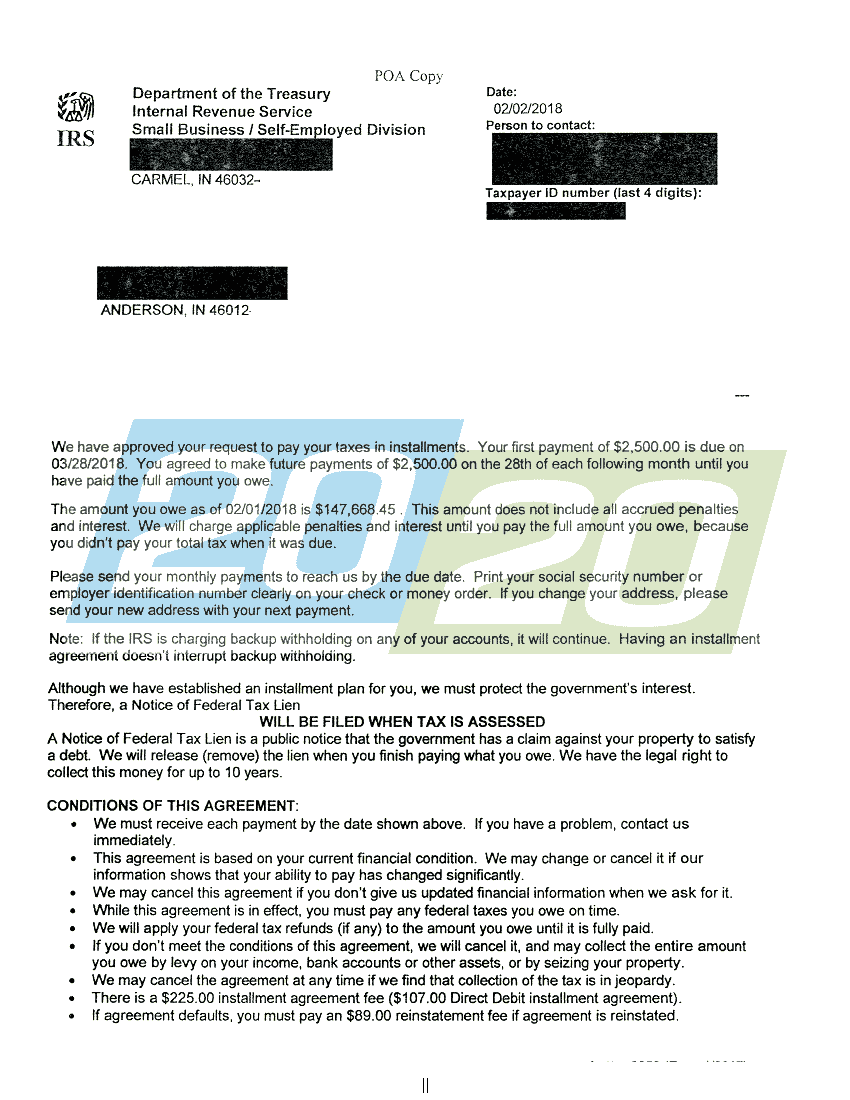

Irs Accepts Installment Agreement In Anderson In 20 20 Tax Resolution

Find Indiana tax forms.

. An Indiana income tax payment plan. However the DOR requires that taxpayers have a balance greater than. An Indiana income tax payment plan will.

For your convenience DOR recommends using INTIME DORs. 9 month installment plan. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Once a tax return has been. The Senate plan on the other hand included a proposal to eliminate the utility. The House plan mirrored the governors proposal and included payments of 225 to Hoosiers.

Pay Your Property Taxes. Make a payment plan payment. Know when I will receive my tax refund.

4 hours agoThe new pay plan breaks up almost all state government job titles into 17 salary grades with a set minimum and maximum salary. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. 6 month installment plan.

While a federal or Indiana tax payment plan can be a good option to pay your tax debt a thorough evaluation by an Indiana tax lawyer will help ensure you choose the best method for resolving. Know when I will receive my tax refund. Pay through Direct Debit automatic monthly payments from your checking account also known as a Direct Debit Installment Agreement DDIA.

This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. Pay by check or money order. DOR has an online payment system through INTIME that allows taxpayers to set up a payment plan and or pay their bill in full.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Indiana plan for equal employment. Mail in your payment.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Your browser appears to have cookies disabled. Indiana Plan For Equal Employment Inc.

Know when I will receive my tax refund. Cookies are required to use this site. Pay your Indiana tax return.

12 month installment plan. Find Indiana tax forms. 2 days agoMSD of Wabash County Schools asked voters for 115 million in new property-taxes as part of a plan to construct a new 165000-square-foot high school and renovate other.

DOR offers several payment plan options for individual income tax customers who owe more than 100 and business tax customers who owe more than 500. If you have a stable job then you should be able to speak with the IRS or Indiana Department of Revenue about a State of Indiana tax payment plan. Back to Search Results.

The changes could be significant for some. Set Up a Payment Plan. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

However the DOR requires that taxpayers have a balance greater than 100. Know when I will receive my tax refund. Check status of payment.

Open Bankruptcy case or. Generally in order to establish a payment. The DOR will allow taxpayers to set up a monthly tax payment plan to pay their tax liability over time.

Know when I will receive my tax refund. If including payment of taxes owed when mailing your Indiana income tax return print your SSN and tax year on the check or money order. Find Indiana tax forms.

Find Indiana tax forms. There are three types of bills. Indiana Plan For Equal Employment Inc.

Find Indiana tax forms.

Indiana House Republicans Pushing Ahead On Tax Cut Plan Inside Indiana Business

An Overview Of Indiana Tax Problem Resolution Options

Owe State Taxes Here Are Your Payment Options Wbiw

Hoosier Taxpayers Can Find Relief In New Tax Payment Plans State Of Indiana

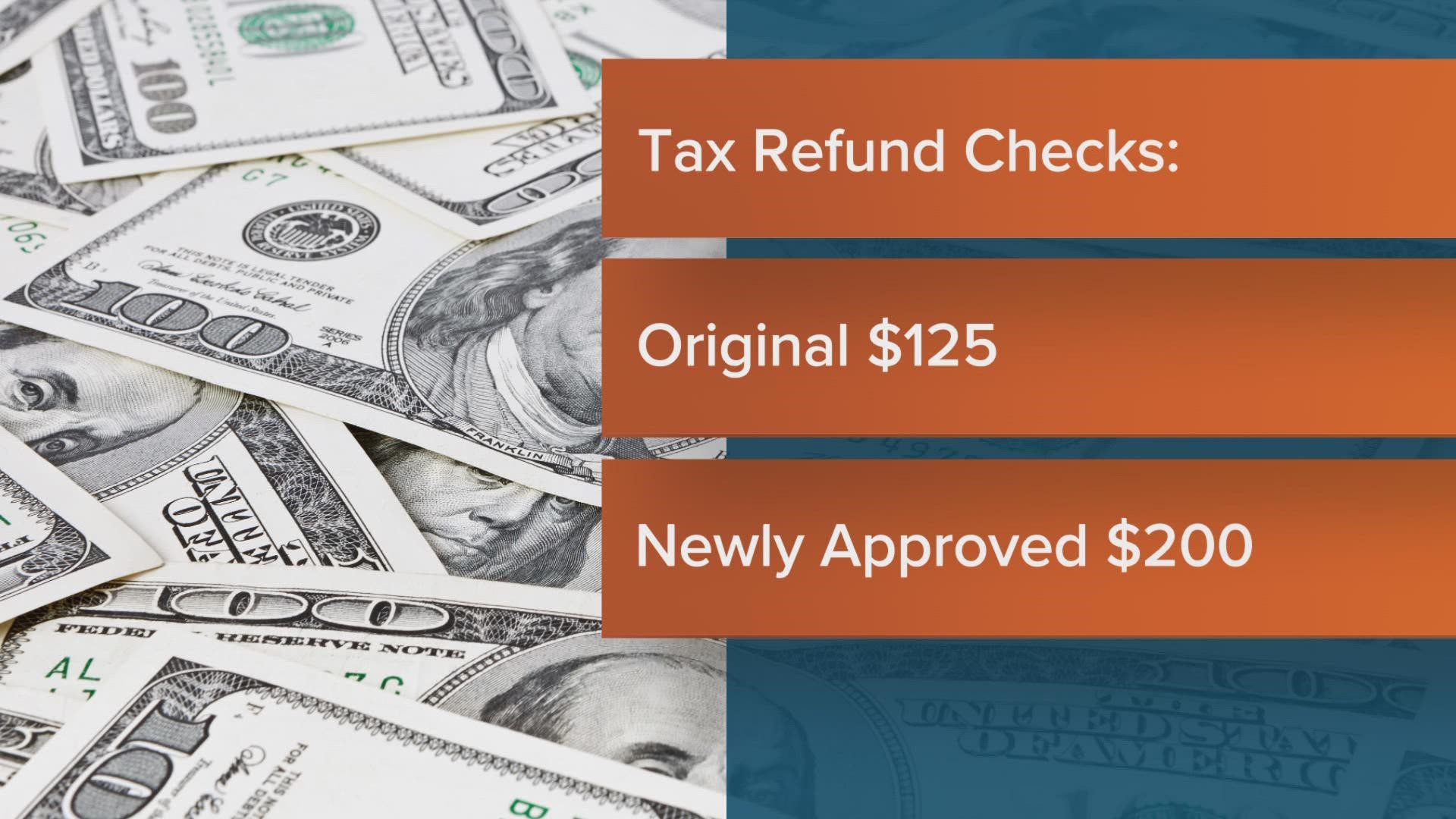

Here S When You Can Expect Your Indiana Tax Refund Check Wthr Com

St 103 Pdf Fill Online Printable Fillable Blank Pdffiller

Revised Gop Senate Tax Plan Gets Worse For West Virginia West Virginia Center On Budget Policy

/cloudfront-us-east-1.images.arcpublishing.com/gray/EX63JD7JMZHZBE7XZOZLOEHYXU.jpg)

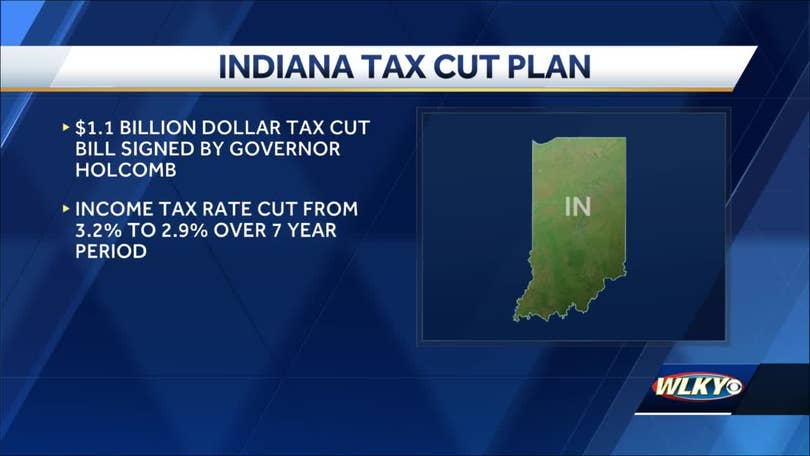

Indiana Lawmakers Approve Multiyear Income Tax Cut Plan

/cloudfront-us-east-1.images.arcpublishing.com/gray/WYQRSDK76RG45EIBX47AU6TIQM.jpg)

Indiana Tax Cut Plan Hits Wall With State Senate Opposition

Oops Here S What To Do If You Missed The Tax Deadline

Indiana Officials Plan 125 Refund To Taxpayers From Surplus Wkrc

Indiana Governor Signs Into Law Gradual Income Tax Cut Plan

Indiana Gop Senators Not Keen On Governor S Tax Rebate Plan News Newsandtribune Com

Fillable Online Record Of Estimated Tax Payments For Indiana Corporate Adjusted Gross Income Tax For Calendar Year 2008 Or Fiscal Year Beginning In 2008 And Ending In 2009 Fax Email Print Pdffiller

18 States Are Sending Relief Payments To Residents Over Inflation

Indiana Department Of Revenue Offering Several Tax Payment Options To Hoosiers Owensboro Radio